In the United States, mortgages play a crucial role in helping people finance their homes. Whether you’re a first-time buyer or considering refinancing, understanding the different types of mortgages available is essential for making the right financial decisions. The U.S. mortgage market offers various options, each with its benefits and drawbacks. This guide will explain the key types of mortgages in the U.S. to help you choose the one that best suits your needs.

What is a Mortgage?

A mortgage is a loan used to purchase or refinance real estate, typically paid back in monthly installments over a fixed term. The property serves as collateral, meaning that the lender can take possession of it if the borrower defaults on the loan.

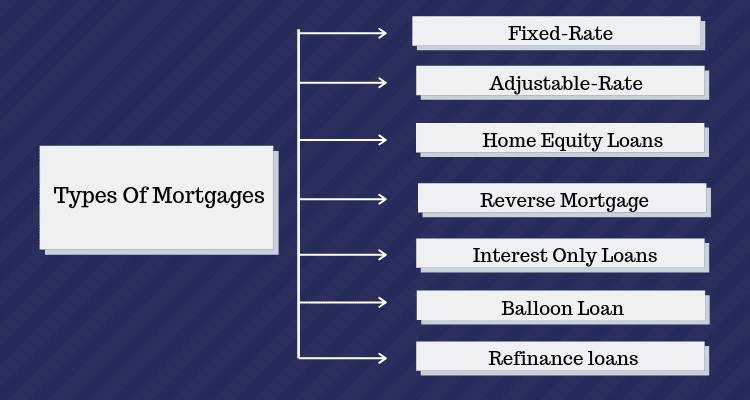

There are multiple types of mortgages available in the U.S., each designed to cater to different borrower needs. These options can vary based on interest rates, loan terms, down payment requirements, and eligibility criteria.

1. Fixed-Rate Mortgages (FRMs)

A Fixed-Rate Mortgage (FRM) is one of the most popular mortgage types in the U.S. With a fixed-rate mortgage, the interest rate remains the same throughout the life of the loan, providing stability in your monthly payments.

Key Features:

- Predictable Payments: The interest rate and monthly payment amount remain fixed, making it easier to budget.

- Loan Terms: Typically available in terms of 15, 20, or 30 years.

Advantages:

- Long-term stability and predictability.

- No risk of rising interest rates.

Disadvantages:

- Higher initial interest rates compared to adjustable-rate mortgages.

- May not benefit from a drop in market interest rates.

A 30-year fixed-rate mortgage is the most common choice for U.S. homebuyers due to its longer term, which makes monthly payments more affordable.

2. Adjustable-Rate Mortgages (ARMs)

An Adjustable-Rate Mortgage (ARM) has an interest rate that can change over time, usually after an initial fixed period. For example, a 5/1 ARM has a fixed rate for the first five years and then adjusts annually based on market conditions.

Key Features:

- Initial Fixed Period: Typically, ARMs offer a lower interest rate for the initial fixed period (e.g., 3, 5, 7, or 10 years).

- Adjustable Rates: After the initial period, the interest rate adjusts based on a specific index.

Advantages:

- Lower initial interest rates than fixed-rate mortgages.

- Potential for lower payments if interest rates decrease.

Disadvantages:

- Rates and monthly payments may increase after the fixed period ends.

- Uncertainty about future payments can make budgeting difficult.

ARMs are suitable for homebuyers who expect to sell or refinance before the adjustable period begins.

3. FHA Loans

An FHA loan is a mortgage insured by the Federal Housing Administration, designed to help first-time homebuyers and those with less-than-perfect credit. FHA loans are more accessible because they have lower down payment and credit score requirements compared to conventional loans.

Key Features:

- Down Payment: As low as 3.5% of the home’s purchase price.

- Credit Score: Borrowers with credit scores as low as 580 may qualify.

Advantages:

- Lower down payment requirements make homeownership more accessible.

- Easier qualification criteria for those with limited credit history.

Disadvantages:

- Borrowers are required to pay mortgage insurance premiums (MIP) both upfront and annually.

- MIP adds to the overall cost of the loan.

FHA loans are ideal for first-time homebuyers or those who have lower credit scores and are struggling to qualify for a conventional loan.

4. VA Loans

VA loans are backed by the U.S. Department of Veterans Affairs and are available to veterans, active-duty military personnel, and their families. These loans are designed to help service members obtain home financing without the need for a down payment or private mortgage insurance (PMI).

Key Features:

- No Down Payment: 100% financing is available for eligible borrowers.

- No PMI: VA loans do not require private mortgage insurance, reducing monthly costs.

Advantages:

- No down payment is required, making homeownership more affordable for veterans.

- No PMI saves money on insurance premiums.

- Competitive interest rates compared to conventional loans.

Disadvantages:

- Only available to eligible veterans, active military, and their families.

- Borrowers must pay a VA funding fee, although it can be rolled into the loan.

VA loans are one of the best options for veterans and active military members who meet the eligibility requirements.

5. USDA Loans

USDA loans are mortgages backed by the U.S. Department of Agriculture and are designed to help low-to-moderate-income borrowers in rural and suburban areas. These loans provide 100% financing, meaning no down payment is required.

Key Features:

- No Down Payment: USDA loans offer 100% financing.

- Eligibility: Borrowers must meet income requirements and the property must be located in an eligible rural area.

Advantages:

- No down payment requirement makes it easier for rural homebuyers to afford a home.

- Competitive interest rates compared to conventional loans.

Disadvantages:

- Only available in USDA-approved rural areas.

- Income limits may apply based on location and family size.

USDA loans are an excellent option for homebuyers in rural areas who meet income requirements and seek affordable financing.

6. Jumbo Loans

A Jumbo Loan is used to finance homes that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). In most parts of the U.S., the limit is $726,200 for a single-family home, but in high-cost areas, it can be higher.

Key Features:

- Loan Amount: Jumbo loans exceed the limits for conforming loans.

- Interest Rates: Typically higher interest rates than conforming loans due to the larger loan amount and increased risk.

Advantages:

- Allows buyers to finance luxury properties or homes in high-cost areas.

- Provides the flexibility to borrow more than conforming loan limits allow.

Disadvantages:

- Stricter credit requirements, including higher credit scores and larger down payments.

- Higher interest rates and potentially higher fees.

Jumbo loans are suitable for high-income earners or those purchasing expensive properties that exceed conforming loan limits.

7. Interest-Only Mortgages

An Interest-Only Mortgage allows the borrower to pay only the interest for a set period, usually 5 to 10 years. After this period, the loan converts to a traditional mortgage, with higher monthly payments to cover both principal and interest.

Key Features:

- Initial Period: Borrowers pay only interest for a specified time.

- Higher Future Payments: Once the interest-only period ends, payments increase to cover both interest and principal.

Advantages:

- Lower initial monthly payments during the interest-only period.

- Ideal for borrowers with fluctuating income or those who plan to sell or refinance before the principal payments begin.

Disadvantages:

- Higher payments after the interest-only period ends.

- May lead to negative amortization if not managed carefully.

Interest-only mortgages are suitable for experienced borrowers or investors who understand the risks and plan to sell or refinance before the interest-only period expires.

Choosing the Right Mortgage

Selecting the right type of mortgage depends on your financial situation, long-term goals, and the type of home you are looking to purchase. Here are a few things to consider when choosing a mortgage:

- Budget: Assess your monthly budget and how much you can comfortably afford for a mortgage payment.

- Loan Term: Decide whether you want a shorter loan term (15 years) or a longer one (30 years) based on your financial goals.

- Interest Rate: Consider whether a fixed-rate or adjustable-rate mortgage best fits your risk tolerance.

- Down Payment: Determine how much you can put down upfront. Some loans, like FHA and VA, require lower down payments, while conventional loans may require more.

Conclusion

Understanding the types of mortgages available in the U.S. is critical to making informed decisions about home financing. Whether you are a first-time homebuyer or looking to refinance, the right mortgage can help you achieve your financial and homeownership goals. Take the time to explore your options, consult with mortgage professionals, and ensure that your mortgage aligns with your financial plans.